The aim of WP1 was to develop an understanding of the commercial and environmental feasibility, requirements and timeline of various clean propulsion technologies and to establish a technology roadmap to direct current and future R&D efforts within a sustainable propulsion ecosystem. This work was done following the established Technology Roadmapping (TRM) method and supported by Delphi panel studies and the analysis of feasibility and GHG-reducing potential of selected technologies. (Deliverable D1.1.2)

The development of alternative fuel markets is the key factor in setting the direction for future propulsion system development. However, the suitability of different fuel alternatives varies depending on the application industry. In the first Delphi study conducted for the project, experts assessed the feasibility of alternative fuels for two time spans (2022–2030 and 2030–2050) and four broad shipping segments (Hellström et al., forthcoming). According to the study, LNG/LPG, biodiesel, and biomethane are stronger contestants among all alternative fuel options (2022–2030). This preference is explained by the higher availability of these fuels and established technologies for their use on ships. In the long term, synthetic fuels, hydrogen, and batteries are expected to become more prevalent as the technologies mature and the availability of the fuels increases. There are differences in the long-term options for alternative fuels depending on the shipping sector:

- Methanol has been mentioned as the most feasible fuel in all segments.

- Ammonia will unlikely be used in cruise and RORO shipping due to the potential hazard to passengers.

- Hydrogen is seen as a potential fuel only for short sea shipping. Its low energy density can explain this and, thus, the need for significant storage space, which will be challenging to implement on vessels in deep-sea shipping.

- Batteries (electricity) are believed to be feasible only on short distances, e.g., ferries.

Another Delphi study was conducted for the offroad sector. According to the study, the cornerstones for limiting emissions in the offroad sector were alternative fuels, hybridisation, and full-electric systems. Moreover, the most prominent power sources selected by the expert panellists were green electricity, biomethane, and biodiesel (and renewable diesel). Electrofuels were not considered likely power sources for the near future. The leading forces restricting the path of change and inhibitors of alteration are the different types of costs related to the transition; also, the short refuelling interval was seen as a challenge in the transition towards alternative fuels, together with the technological complexity of the new solutions. (Deliverable D1.2.2)

Regarding full-electric systems, electrochemical recuperators (ECR, a technology studied in the project) could prove beneficial. An LCA of this technology as applied to a city bus in Finland was conducted within WP1. The results showed that although ECR cells generate higher CO2-eq than LFP in manufacturing, its application to battery-electric or hybrid bus indicated that ECR was 23 times and 110 times better than LFP for global warming potential. (Mayanti, forthcoming)

Depending on the application area, there are unique opportunities for local, decentralised, or distributed fuel production in the offroad sector. Management of energy and biomass flowing circularly is possible in the case of fuel production on farms and may provide interesting business cases for alternative fuels. In a separate study on alternative fuels for offroad vehicles on farms, a comparative economic assessment was made for local hydrogen production on farms, considering fuel use on typical crop farms in four countries: Germany, Italy, Sweden and the US. The main conclusion is that hydrogen can replace diesel on farms, but its current economic prices make it impractical for small farms. (Deliverable D1.4.1)

Another case study was conducted on the environmental and economic aspects of an increased use of LBG as a fuel for a RoPax vessel alongside varying carbon pricing strategies. Assuming that the net zero scenario is applied, the carbon costs of using MDO, LNG or LBG will range between 52-73%, 43-74%, and 12-23%, respectively (depending on the fuel price development). The increasing carbon costs will likely make ship operators consider alternative fuels. although LNG still seems to be the least expensive option in 2030 and 2050. (Mayanti et al., 2023)

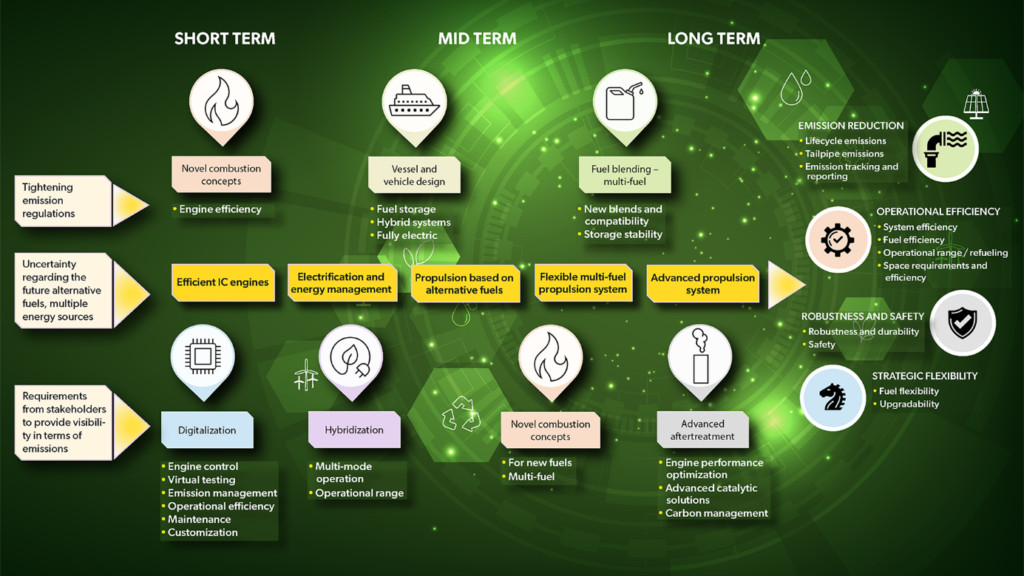

Apart from the developments in the alternative fuel and energy market, the key market drivers for the development of clean propulsion technologies are, not surprisingly, of regulatory nature: GHG emission regulations in the maritime sector, expected inclusion of CO2 emission limits in off-road sector standards, and regulations related to pollutant emissions. There is also an industry pull for clean solutions, which is intertwined with green financing models. The uncertainty regarding which alternative fuels and energy sources will replace fossil fuels in the maritime and off-road sector has significant implications for the development propulsion systems towards greater flexibility and upgradability. (Tsvetkova et al., forthcoming)

The combined effect of the market drivers, the developments in the fuel and energy sector, and internal to the cluster business drivers (like e.g. the focus on the total cost of ownership of propulsion solutions and the ambition to be first movers in delivering technology breakthroughs), together set several requirements towards future clean propulsion systems (see below).

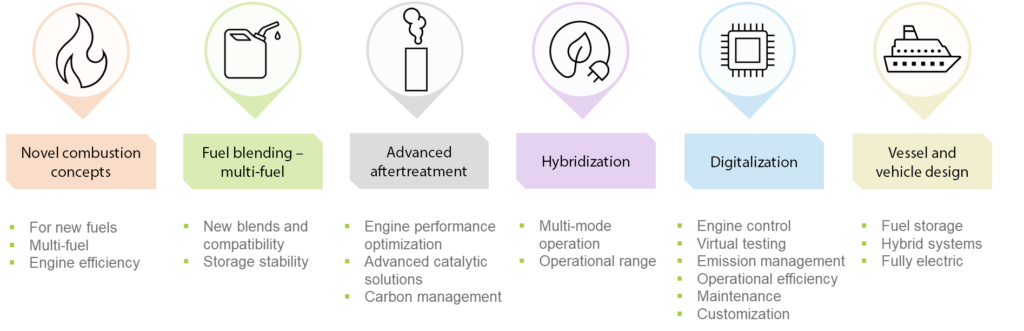

To develop products and services that can fulfil these requirements, technological developments within several technology areas are prioritised in the developed roadmap: novel combustion concepts, fuel blending and multi-fuel technologies, advanced aftertreatment, hybridization, digitalization, and vessel and vehicle overall design.

The pursuit of rapid GHG emission reduction, driven by stringent legislation, has converged the trajectory of clean propulsion solutions in the maritime and offroad sectors. While each sector faces distinct constraints, such as energy density, packaging, and the balance between equipment cost and TCO, their shared commitment to long-lasting assets and the demand for operational safety and durability align. This convergence steers the industry toward developing advanced combustion concepts in the maritime sector, while the offroad sector prioritises hybridisation to achieve immediate GHG emission reductions and maintain the power range of ICE platforms. Notably, the marine and offroad industries traditionally cater to different market segments, fostering a unique opportunity for cross-sector collaboration. This collaboration not only addresses the rising cost of pioneering solutions but leverages collective insights, enabling each sector to forge its path towards a sustainable future independently. A common roadmap for the Finnish clean propulsion technology cluster in visualised below.

Magnus Hellström

Professor, Åbo Akademi University

WP1 leader of Clean Propulsion Technologies

Anastasia Tsvetkova

Project Researcher, Åbo Akademi University

Deliverables and publications of WP1:

- Deliverable D1.1.1 “An intermediate report on the Technology Roadmap for clean propulsion: drivers for clean propulsion”

- Hellström, M., Mikulski, M., Nylund, N.-O., and Wik, C., 2023. A new look at the maritime propulsion roadmap – Exploring co-development with the off-road sector. Paper presented at CIMAC Congress in Busan, Korea, 12-16 June 2023.

- Tsvetkova, A., Hellström, M., Schwartz, H., Rabetino, R., & Hammad, S., 2023. A transition towards clean propulsion in shipping: the role of PESTLE drivers and implications for policy, Marine Policy (forthcoming).

- Deliverable D1.1.2 “The final report on the technology roadmap for clean propulsion”

- Deliverable D1.2.1 “A report on the decarbonization of the shipping industry and the future of alternative fuels”

- Hellström, M., Rabetino, R., Schwartz, H., Tsvetkova, A., & Hammad, S., 2024. GHG emission reduction measures and alternative fuels in different shipping segments and time horizons – A Delphi study. Marine Policy, Volume 160, February 2024, 105997. https://doi.org/10.1016/j.marpol.2023.105997

- Deliverable D1.2.2 “A report of the decarbonization of the non-road mobile machinery”

- Deliverable D1.3.1 LCA/LCC Results reports

- Mayanti, B., 2023. Life cycle assessment of lithium iron phosphate and electrochemical recuperator cells for city busses in Finland, Environmental Impact Assessment Review (forthcoming).

- Mayanti, B., Hellström, M., and Katumwesigye, A., 2023. Assessing the decarbonisation roadmap of a RoPax ferry (submitted manuscript).

- Deliverable D1.4.1 “Alternative fuels for offroad vehicles. Pathways, production processes and applicability to farming”